As always please reach out with any questions or concerns.

Thank you,

Joseph Sharma, CFA

Chief Investment Officer

Direct: (908) 741-8340

Recall, in our 3Q 2024 Quarterly Newsletter, we stated:

Currently, the weight of the largest 10 stocks in the S&P 500 is about 37%, which is in the 97th percentile since 1964 and well above the Tech Bubble. We believe this elevated level of extended concentration may begin to unwind in 2025 as investors recognize more attractive combinations of valuations+ earnings growth in the other non-Mag 7 stocks.

As we head into the earnings reporting season, Mag 7 earnings in aggregate are expected to increase +21.7% y/y in Q4 2024, with Nvidia, Amazon, Google, and Meta as standouts, while Microsoft and Apple forecast to grow less than 10%. This compares to the +9.7% growth expected for the remaining 493 S&P 500 companies, which would mark the best growth since Q2 2022.

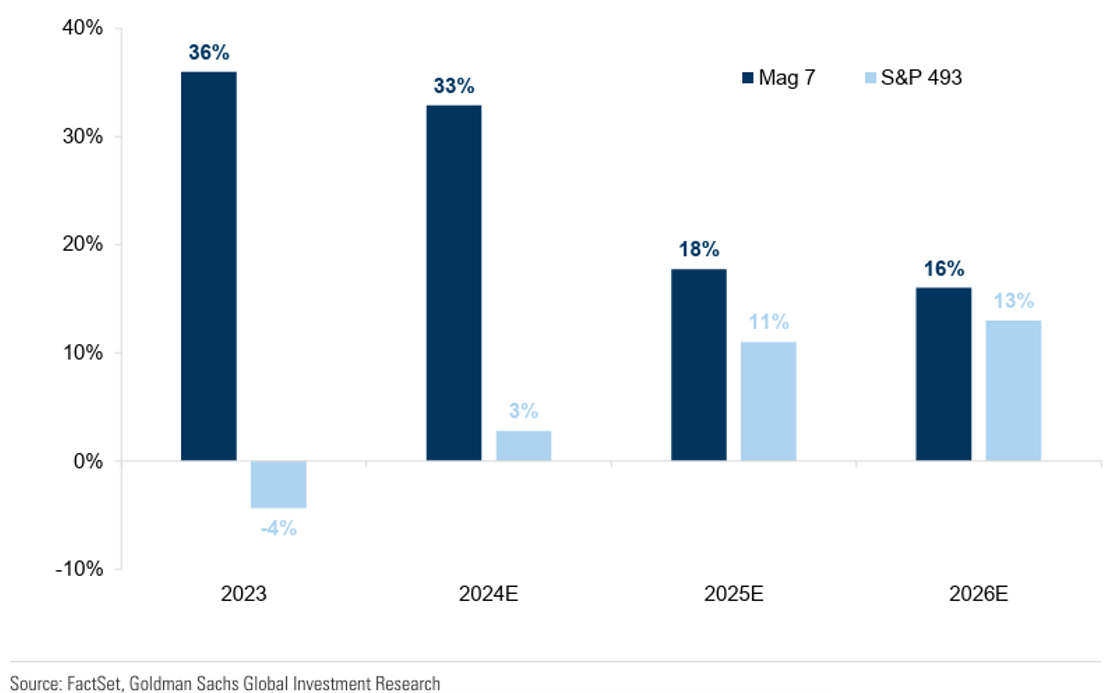

Importantly, as we enter 2025, Mag 7 stocks are expected to grow earnings by about 18% (further deceleration), while the remaining 493 S&P 500 companies are expected to grow earnings by about 11% (further acceleration), according to Goldman Sachs. Furthermore, the earnings growth “gap” is expected to narrow further in 2026.

Elevated valuation multiples, higher investor expectations, and decelerating forward earnings growth rates are typically not a healthy combination for outsized equity performance. These are the characteristics that we currently see in Mag 7 stocks.

We believe the narrative has clearly shifted from the “recession/soft landing” debate in 2024 to continued economic expansion in the US economy. In our 3Q 2024 Quarterly Newsletter, we stated, “we are on the cusp of a new economic cycle.” As we wrap up the 4Q 2024 earnings reports from the large financial institutions, we are increasingly positive on the US economy for 2025. Credit, deposit, and loan growth trends remain positive. Troubled areas of the economy like commercial real estate appear to be slowly healing.

At Oliver Luxxe Assets, we seek to identify businesses with attractive return on invested capital and durable cash flow generation trading at undemanding valuations. Our ongoing analysis continues to support our strategy, and our conviction is reinforced as we see many opportunities in the cyclical areas of the US economy where profit margins are expanding from depressed levels and have low investor expectations. We believe this combination could drive attractive returns over the coming years.

As always please reach out with any questions or concerns.

Thank you,

Joseph Sharma, CFA

Chief Investment Officer

Direct: (908) 741-8340

Disclaimer:

Investments in securities entail risk and are not suitable for all investors. This is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction. All investment strategies have the potential for profit or loss; changes in investment strategies may materially alter the performance and results of a portfolio. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

This document may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the US market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to the success or lack of success of any particular investment strategy. All are subject to various factors, including, to general and local economic conditions, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involve a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of Oliver Luxxe or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made.