As always please reach out with any questions or concerns.

Thank you,

Joseph Sharma, CFA

Chief Investment Officer

Direct: (908) 741-8340

From an equity investment perspective, we believe higher interest rates will increase the cost of capital for businesses and consumers, especially those that have high and variable debt structures. As a result, it will require investors to place greater scrutiny on a firm’s capital structure more than they did in previous years when interest rates and borrowing costs were at abnormally low levels. Individual financial statement line items such as interest expense, interest income, and net debt have become increasingly important in business valuation. For example, the year-over-year change in the S&P 500’s trailing 12-month borrowing cost has risen as the Federal Reserve increased the policy rate to fight inflation.

Year to date, the S&P 500 Index has delivered positive gains. Of greater concern to us is that the performance of the largest ten companies by market capitalization in the S&P 500 have driven much of the index’s returns during 2023. Investors have allocated capital to these stocks due to perceived “safety” (i.e., low volatility), strong balance sheets, and varying exposure to artificial intelligence (AI). We believe this may be indicative of caution around future economic growth as investors seek assets that are well-established and have strong moats around their business models. However, history has shown that these periods of excessive concentration tend to “mean-revert” as investors tend to over-extrapolate future sales and earnings streams of these recent trends (the Internet phenomenon in the late 1990s). As shown below, recent S&P 500 concentration has approached levels well above prior cycles seen during the dot-com bubble and Great Financial Crisis.

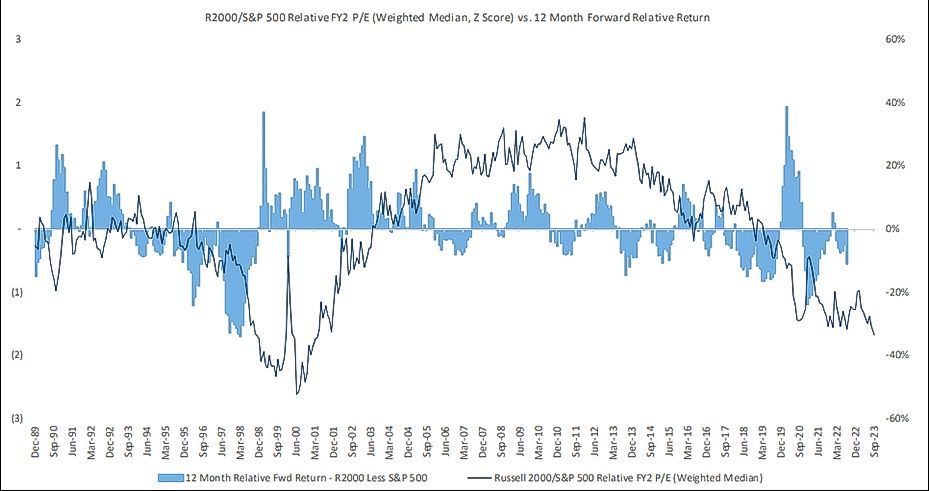

Conversely, small cap stocks are trading at the widest valuation spreads versus large cap stocks since the late 1990s.

The common perception is that small cap stocks tend to have weaker balance sheets and higher costs of capital. As such, higher interest rates and weaker economic growth should have a greater adverse effect on small cap stocks than their larger brethren. In fact, many market prognosticators would point to the fact that approximately one-third of the companies in the Russell 2000 Index aren’t profitable so why invest in this asset class!

Our simple response is if one-third of small cap companies don’t generate earnings what about the remaining two-thirds of businesses that do make money, generate sustainable cash flows and trade at a significant discount to the S&P 500 Index?

Outlook

At Oliver Luxxe Assets we utilize a “Private Equity Approach to the Public Marketplace.” We’re agnostic to the growth versus value debate. In fact, as Warren Buffet stated, “growth is part of the value equation.” Like private equity investors, we’re more interested in the economic value of the underlying enterprise. We place emphasis on balance sheet integrity, operating and free cash flow generation and management’s ability to allocate capital efficiently.

During the significant Nasdaq correction of 2022, we were able to identify attractive investment opportunities, especially with the large cap areas of the market. Companies like Alphabet Inc and Meta Platforms were trading at double-digit free cash flow multiples combined with pristine balance sheets. These businesses “earned” their way into our Large Cap and Allcap strategies by virtue of their undemanding valuations and cash flow generation strength. We have since reduced our positions in these holdings as their valuation multiples has significantly increased in 2023. Today, we are seeing a similar valuation set-up as we did late last year but in the small and mid-cap cyclical areas of the US equity market due to the abnormally wide valuation spreads that exist between large and small cap stocks (see chart above). As we have stated in previous publications, we view investing of any kind (equity, fixed income, real estate, etc.) as a “point to point endeavor in pricing discovery.” Identifying appropriate entry points hopefully enables us to generate attractive risk-adjusted returns over the long term with potentially some margin of safety. Ultimately, our goal is to identify areas of the capital markets where we believe capital is inefficiently allocated and avoid areas where too much capital is chasing elevated expectations.

As always please reach out with any questions or concerns.

Thank you,

Joseph Sharma, CFA

Chief Investment Officer

Direct: (908) 741-8340

Disclaimer:

This document may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “should,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including general and economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involve a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of Oliver Luxxe Assets or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. This is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.” Investments in securities entail risk and are not suitable for all investors. This is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.