As always please reach out with any questions or concerns.

Thank you,

Joseph Sharma, CFA

Chief Investment Officer

Direct: (908) 741-8340

On the other hand, the March Services PMI fell to 51.4 from 52.6 in February and was the second straight monthly decline in the index since rebounding in January. Both reports showed that prices-paid component fell to the lowest level since March 2020, a rebound in the manufacturing economy and a strong jobs market. All of which are positive signals for the US economy.

From a jobs perspective, March non-farm payrolls rose to 303k, which was 89k above consensus expectations, leading to an unemployment rate of 3.8% compared to 3.9% in February of 2024. While overall labor shortages are easing, there continues to be approximately 1.4x jobs available for each unemployed worker versus 2x at the peak in 2021. The strong labor market continues to be a bright spot for the US economy, as the unemployment rate has remained below 4% for 26 straight months.

The Leading Economic Index (LEI) is a leading indicator of significant turning points in the business cycle and provides a signal of where the economy is heading in the near term. The latest reading of the LEI rose +0.1% to 102.8, which marked the first improvement since February of 2022. The LEI increased due to an improvement in weekly hours worked in manufacturing jobs, stock prices, and residential construction growth (first monthly increase in two years). Since the Leading Economic Index is a predictive variable (forward-looking) that anticipates turning points in the business cycle by ~7 months, we believe this recent report provides a constructive outlook for the US economy.

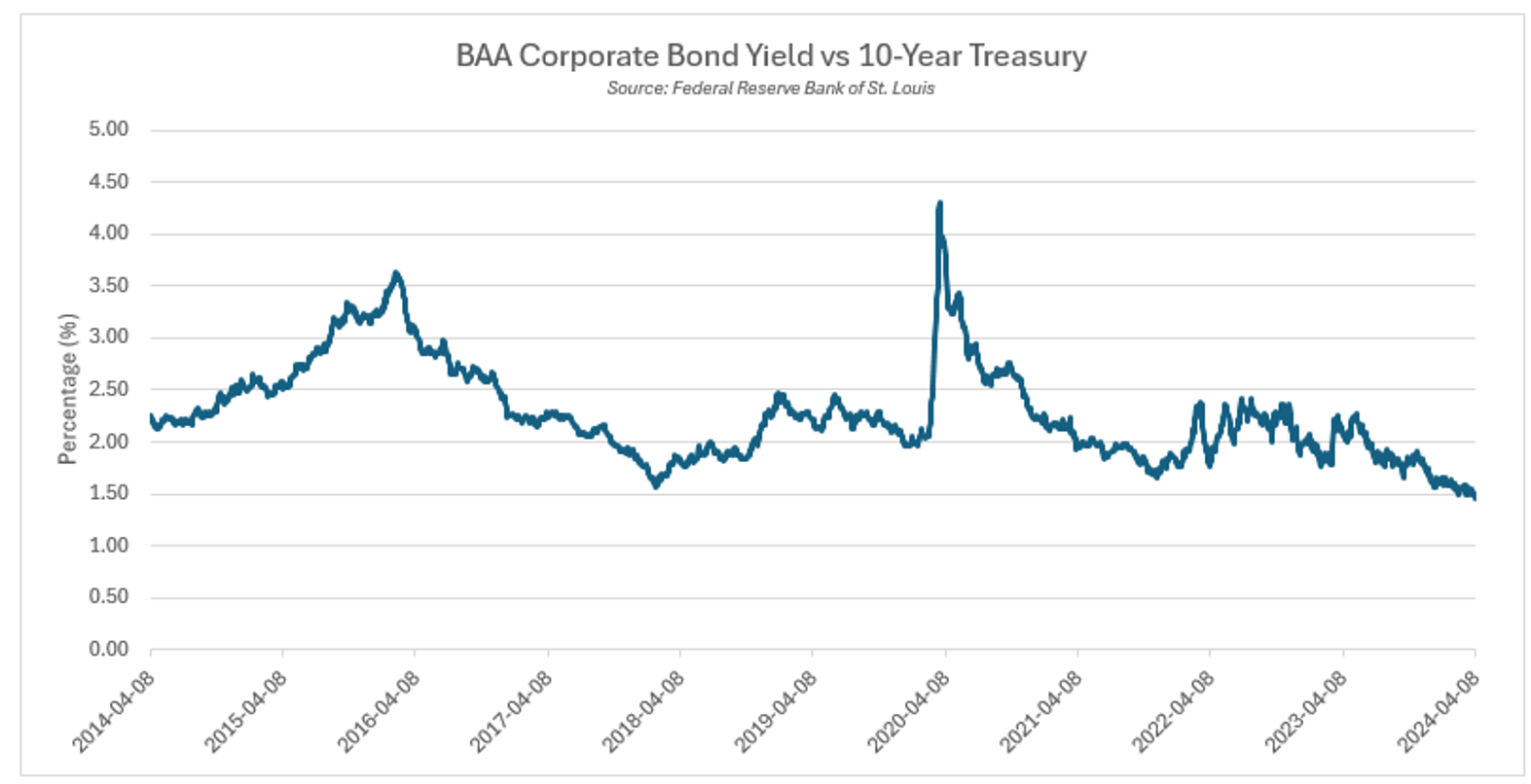

The “BAA Spread” is an economic data point that assesses the expectations of the credit quality for lower-rated businesses. This is one of our long-time favorite indicators. At quarter-end, the spread was 150 basis points, which marked the lowest level in 10 years. It has further declined to 148 basis points as of April 8th. The narrowing BAA spread suggests that investors are increasingly confident in the economic outlook for some of the lowest-rated credits. Oftentimes fixed income investors view BAA-rated companies as similar to equities due to their lower positioning in the capital structure.

Outlook

Investors were anticipating multiple interest rate cuts in 2024. This resulted in significant outperformance of low-quality, high beta stocks with leveraged balance sheets to finish the final weeks of 2023. As the First quarter of 2024 progressed it became apparent that the overall US economy was still on solid grounds. In fact, interest rates have risen to reflect this ongoing economic strength. As expected, much of the “junk” rally that occurred late last December has since disappeared. There appears to be little reason for the Federal Reserve to lower interest rates soon. However, after raising interest rates by +500 basis points since early 2022 into a $26 Trillion US economy, this will eventually result in reduced economic growth. As such, we believe that interest rates will head lower towards the back half of 2024 and a new economic growth cycle should emerge. At Oliver Luxxe Assets, we continue to focus on our

Private Equity in the Public Marketplace investment approach. Most importantly, we seek to identify businesses that have attractive entry points, strong and sustainable cash flow generation, and management teams that have a long-term view on enhancing shareholder value.

As always please reach out with any questions or concerns.

Thank you,

Joseph Sharma, CFA

Chief Investment Officer

Direct: (908) 741-8340

Disclaimer:

Investments in securities entail risk and are not suitable for all investors. This is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction. All investment strategies have the potential for profit or loss; changes in investment strategies may materially alter the performance and results of a portfolio. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

This document may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the US market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to the success or lack of success of any particular investment strategy. All are subject to various factors, including, to general and local economic conditions, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involve a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of Oliver Luxxe or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made.