Small-Cap Value Investing in 2022

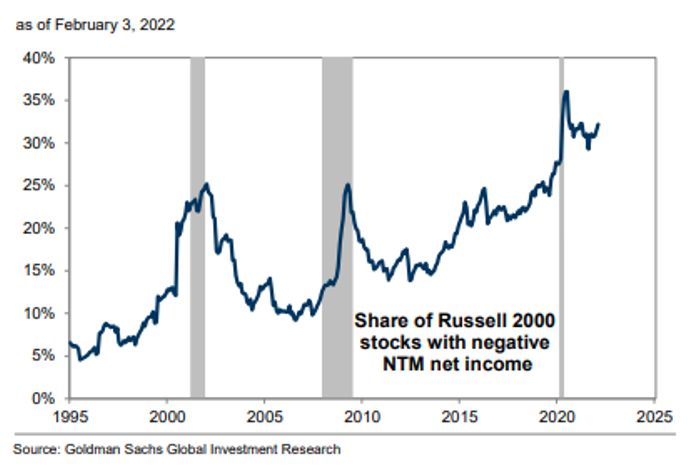

According to Goldman Sachs, approximately a third of the Russell 2000 companies will be unprofitable as of February 3, 2022 (see below).

This is important because the Federal Reserve is projected to raise interest rates in 2022, which effectively increases the discount rate (and cost of capital) used to value companies. Higher duration equities (i.e., those with earnings expected in later years) could potentially be impacted more relative to high-quality, low duration equities, which we seek to identify for our equity strategies. As a result, we believe investment performance may see wide dispersion between fundamentally driven, active portfolio management and passive investment strategies, especially in the small-cap universe over the next few years.

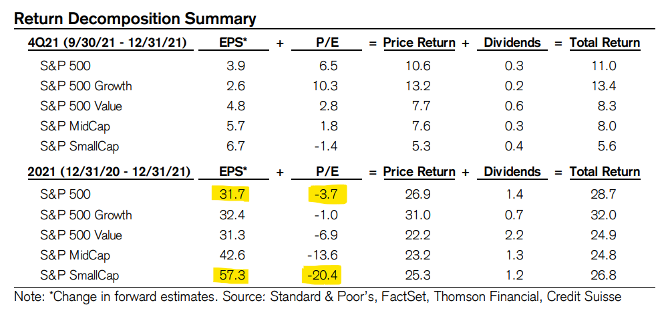

As we outlined in our 2021 year-end review, we believe there could be a significant “coiled spring” effect in 2022 for small-cap equities. This is due to the 20% decline in S&P Small-cap P/E multiples in 2021 despite +57% EPS growth which was higher than the S&P 500’s +31% growth[1].

We believe the fundamental setup in 2022 is compelling for small-cap investing. Small-caps tend to perform best and outperform large-cap companies when the economic cycle enters the recovery phase. More importantly, this trend usually starts a multiyear cycle where investors prefer small-cap equities which have lagged their large-cap counterparts.

From a valuation perspective, large-cap stocks are trading well above their 10-year averages on a variety of metrics (See highlights below). Conversely, small-cap stocks are trading below their 10-year averages on many metrics. We believe this combination of large-cap “overvaluation” and small-cap “undervaluation” is a powerful setup for rotation towards value and small-cap stocks. This is very reminiscent of what happened during the 1995-2005 period, where large-cap growth significantly outperformed from 1995-1999, and small caps and value took leadership from 2000-2004 after the technology “bubble” period.

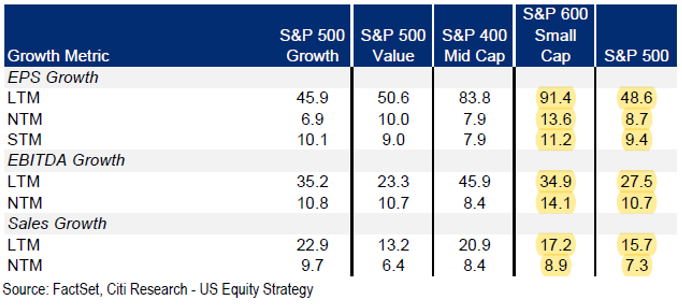

From a growth standpoint, small caps earnings are projected to grow faster than the large-cap peer group. (See highlights below). In fact, this combination of superior valuation+ higher EPS growth, EBITDA growth and sales growth suggest that small-cap stocks are currently mispriced versus the large-cap universe.

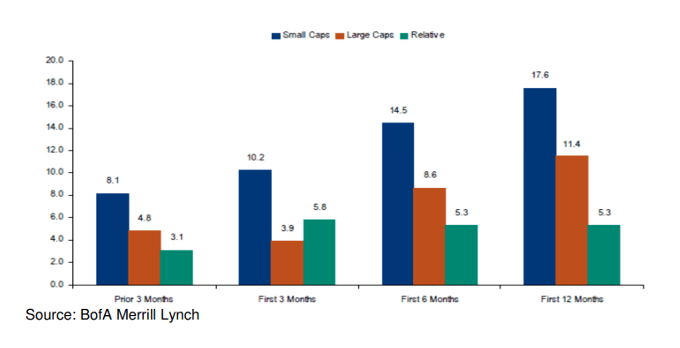

After the Great Financial Crisis, investors have become comfortable believing that “growth is defensive,” which is consistent with easy monetary policy for the past decade. However, we believe as interest rates move higher in 2022, investors should reward high-quality, small-cap value stocks. Importantly, Small-cap stocks have outperformed their large-cap counterparts during periods immediately prior and after Fed rate hikes.

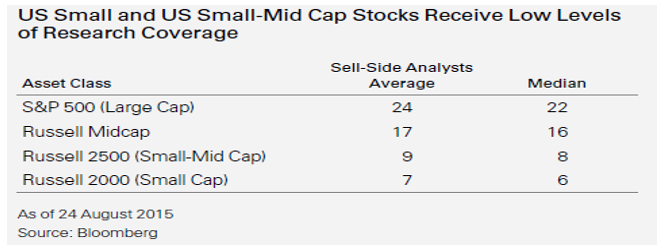

The small-cap universe is extremely vast, with many companies that are under-followed by Wall Street sell-side research analysts. Because this universe is not as widely followed, it creates an alpha opportunity for active managers like Oliver Luxxe to add value through our disciplined proprietary research process. Our process combines a rigorous fundamental approach as well as a quantitative layer. We utilize our multi-factor quantitative screens to assist in identifying companies with solid balance sheets, strong earnings revisions, and attractive multiples. We utilize the quantitative models to prioritize our research resources in the most efficient manner. Our fundamental research includes in-depth analysis of the company’s business model, industry competitive dynamics, financial statements, discounted cash flows analysis and evaluating management’s track record of generating/deploying capital in an efficient and shareholder-friendly manner.

Ultimately, our goal is to build a portfolio of attractively valued businesses with solid ROIC, strong cash flows and reinvestment opportunities, broadly diversified amongst economic sectors and industries. We believe this combination gives us the best opportunity to deliver a set of attractive risk-adjusted returns through the economic cycle.

Small-Cap Company Highlights

Franchise Group, Inc. (FRG). Franchise Group is an owner and operator of franchised businesses that continuously look to grow its portfolio of brands. FRG’s portfolio includes Pet Supplies Plus, American Freight, The Vitamin Shoppe, Badcock Home Furniture, Buddy’s Home Furnishings and Sylvan Learning. Franchise Group acquires franchisable businesses and adds operating and capital allocation philosophies needed to grow free cash flow and earnings. FRG has a strong history of driving shareholder value, as exhibited by its increasing return on invested capital (ROIC) and its recent decision to increase its quarterly dividend by +67% to $0.625/per share. We believe FRG’s accretive strategy of buying scalable franchise businesses is repeatable and can drive competitive long-term earnings growth.

Vista Outdoor Inc. (VSTO). Vista is a designer, manufacturer, and marketer of consumer products in the outdoor sports and recreation markets and the company's segments consist of Shooting Sports (68% of sales) and Outdoor Products (32% of sales). VSTO has grown its diverse portfolio via acquisitions and strong organic growth. We believe Vista’s $474mn purchase of Foresight Sports highlights the company’s strategy to grow via accretive acquisitions ($60mn in tax benefits). Due to strong consumer spending and M&A, VSTO has some of the strongest Consumer Discretionary earnings revisions on our proprietary small-cap quantitative screen. Vista trades at a forward EV/EBITDA multiple of 4.5x which is two standard deviations below its five-year average.

Carriage Services Inc. (CSV). Carriage Services is a provider of funeral services in the United States and operates approximately 171 funeral homes across its Funeral Home Operations (75% of sales) and Cemetery Operations (25% of sales) segments. Carriage Service’s historical revenue/EBITDA growth rates of +6%/+8% have been driven by strategic M&A, improving EBITDA margins, and its ability to decrease its cost of capital. Despite CSV’s better growth metrics versus its peer Service Corporation International (SCI), the company trades at a forward EV/EBITDA multiple of 12x which is two and a half turns lower compared to Service Corporation International.

Contact Us