The Case for SMID-Cap Equities

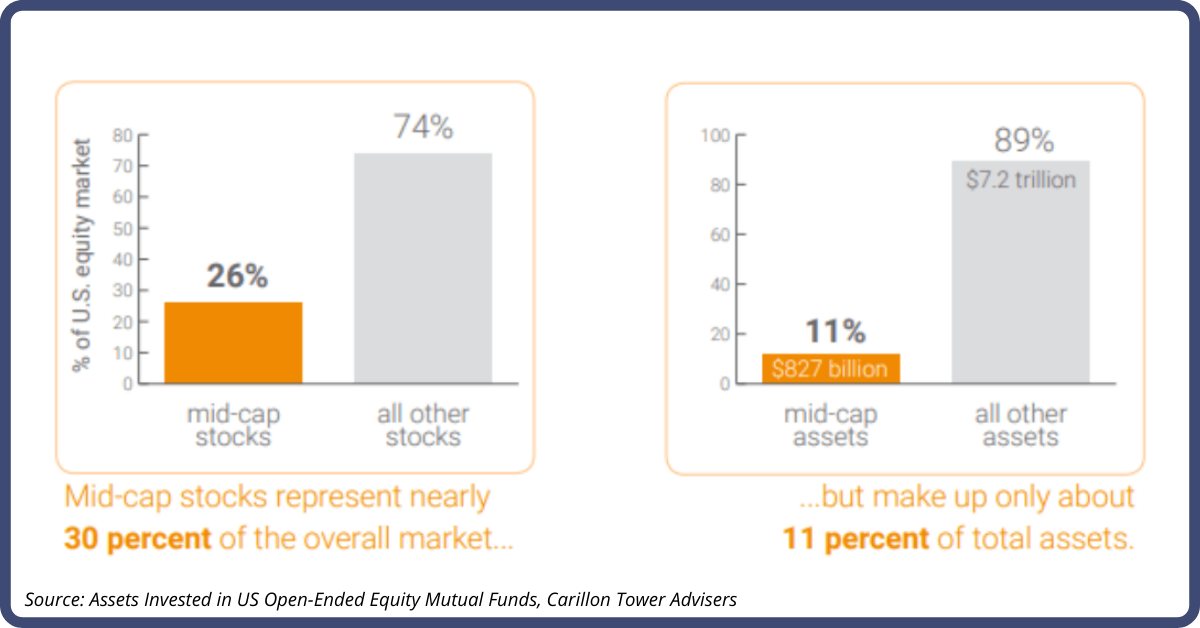

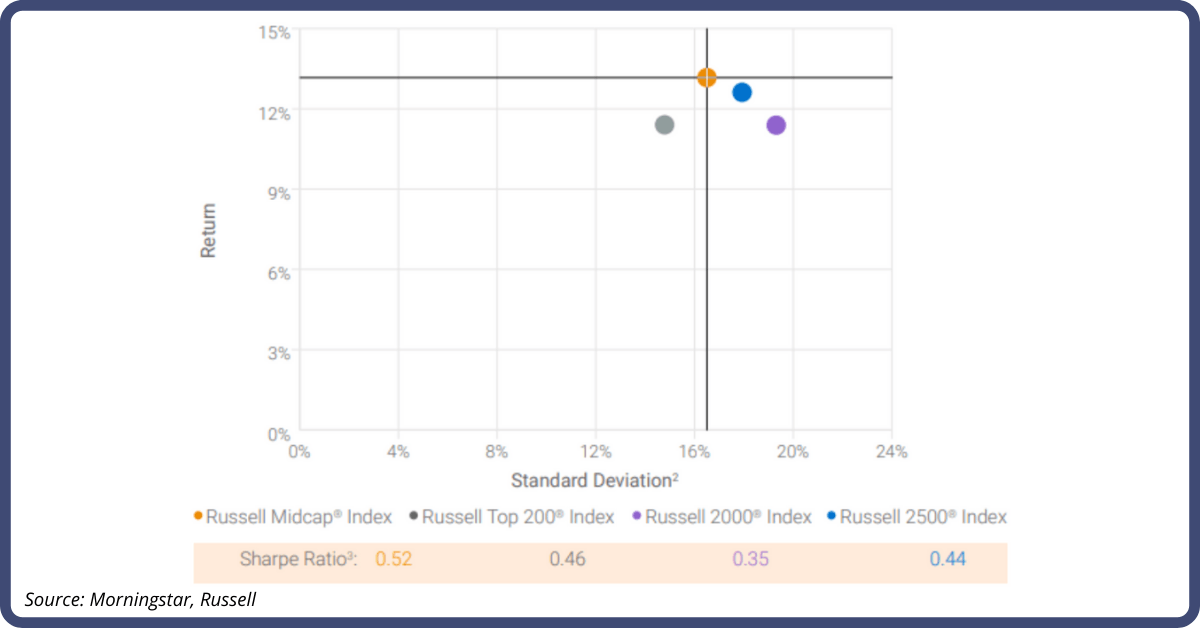

Mid-cap equities usually deliver higher risk-adjusted returns (i.e., higher Sharpe Ratio) compared to large and small cap stocks. In the past, it appears that investors most likely missed out on opportunities to improve their diversification and absolute returns by not adding SMID-cap equities to their asset allocation. From 1979 to 2019, the Russell MidCap Index delivered a Sharpe Ratio of 0.52 versus 0.46 for the Russell Top 200 Index (large cap proxy) and 0.35 for the Russell 2000 (small cap proxy). SMID-cap stocks also have favorable growth attributes like EPS growth rates. Over the past twenty years, SMID-cap companies have driven EPS growth rates of +10.7% compared to large/small cap growth of +9.2%/+10%, respectively.

SMID-Cap Companies:

Atkore (ATKR) Inc is a $4.4bn electrical products company that holds an attractive end-market position in residential (34% of FY20 sales) and non-residential (33%) end-markets. Over the past two years, the company has consistently delivered earnings upside to consensus estimates due to two core competencies. First, Atkore is the largest PVC supplier in its key geographies, which results in strong pricing power and further ability to capture positive pricing above inflation. Said differently, Atkore’s customers have less price elasticity because ATKR is one of the few suppliers who can meet all their needs. While many industrial companies have cited commodity inflation as a gross margin headwind, ATKR has benefitted from these trends, driving average selling prices (ASPs) up +35% Y/Y in Q121. Secondly, ATKR’s strong free cash flow generation has allowed management to reduce leverage well below its financial targets of 2x net debt/adj. EBITDA. Atkore’s net leverage currently stands at 0.9x, which allows management to engage in bolt-on M&A (bought two businesses YTD) and repurchase shares (expects $35mn-$55mn in FY21). To that point, we view these capital allocation priorities as justified, given that ATKR has almost doubled its return on invested capital (ROIC) from 7% in 2016 to 13% in 2020.

Herc Holdings, Inc. (HRI) is a $3.9bn company benefiting from a pronounced rebound in the construction equipment market as it leverages its footprint to absorb high levels of customer demand. Additionally, HRI is driving time utilization (i.e., product yield) to pre-COVID levels and is seeing dollar utilization improving too. These positive dynamics are occurring without any signs of restocking, according to HRI’s management team, which should set up a very strong 2022. In 1Q21, HRI noted that they expect to drive pricing 1x to 2x above inflation throughout the cycle and should see pricing benefit from mix (specialty equipment portfolio). Much like peers (URI and Sunbelt), HRI believes they are in the early stages of a pricing recovery due to pent-up demand, record amounts of monetary and fiscal stimulus, and market share gains. Despite its strong YTD performance, HRI is attractively valued at 15x consensus FY22 adj. EPS which is in line with its three-year average. We are constructive on HRI's ability to drive earnings revisions higher based on 2022 order trends, positive supplier commentary (Terex, Oshkosh), conservative guidance, and a well-established market outlook.

LKQ Corporation (LKQ) is a $15.2bn market cap company that engages in the distribution of vehicle repair parts across North America and Europe. LKQ has driven consecutive quarters of above-market growth due to its massive scale (40x larger than the largest competitor in North America), balance sheet flexibility, and improved margin structure. Before COVID, the company embarked on its “One LKQ” restructuring program, which focused on rightsizing its footprint, specifically in Europe. Last month LKQ mentioned that they expect normalized adj. EBITDA margins to be >16% in North America and >10% in Europe (vs. 8% historically). Improvements in EBITDA margins are primarily driven by lower SG&A expense ($80mn in permanent savings), gross margin gains from optimized routes/operational efficiencies, exiting lower-margin businesses, and incremental pricing, which offsets inflation. LKQ’s strong free cash flow conversion has allowed them to de-lever, resulting in their first Investment Grade Credit Rating (-BBB). By achieving an Investment Grade Credit Rating, it removes a $3.5bn lien on its credit facility and creates more favorable borrowing/payables terms. Despite making solid progress towards its restructuring initiatives throughout COVID-19, LKQ trades at 15x consensus FY22 adj. EPS which is well below the auto aftermarket peer average of 18x.

Contact Us