As always please reach out with any questions or concerns.

Thank you,

Joseph Sharma, CFA

Chief Investment Officer

Direct: (908) 741-8340

Upside to 2021 earnings expectations was mixed across sectors but many firms were able to pass through inflation to customers to achieve neutral or positive price-cost. Throughout the year we worked diligently to identify and acquire companies that had strong pricing power-driven by scale and high value-added products and services. For example, Atkore Inc. (ATKR) is a $5.3 billion electrical equipment company which benefitted from raw material inflation during 2021 as they successfully passed through price in excess of cost ($391mn pricing vs $291mn cost in F4Q21)[2]. Atkore was able to do so because they were one of the only companies in the U.S. that had the scale to meet surging demand in PVC, conduits, and other cable products[3]. However, companies like Atkore which saw outsized earnings growth last year may see earnings power normalize in 2022 and see the second derivative (i.e., positive rate of change) eventually slow.

The companies that delivered stronger earnings during 2021 (like energy, industrials, and basic materials) saw a larger contraction in their multiples (especially in the small-cap universe). For instance, EPS growth contributed +57.3% to Small-cap’s annual return for 2021 but witnessed P/E multiples contract -20.4%. This compared to Large-cap’s +31.7% increase in EPS and -3.7% multiple contraction[4]. We believe this significant Small-cap forward P/E multiple compression in 2021 creates a “coiled spring” effect opportunity in 2022.

[2] Company Press Release

[3] Company Earnings Presentation

[4] Standard & Poor’s, FactSet, Thompson Financial, Credit Suisse

OUTLOOK:

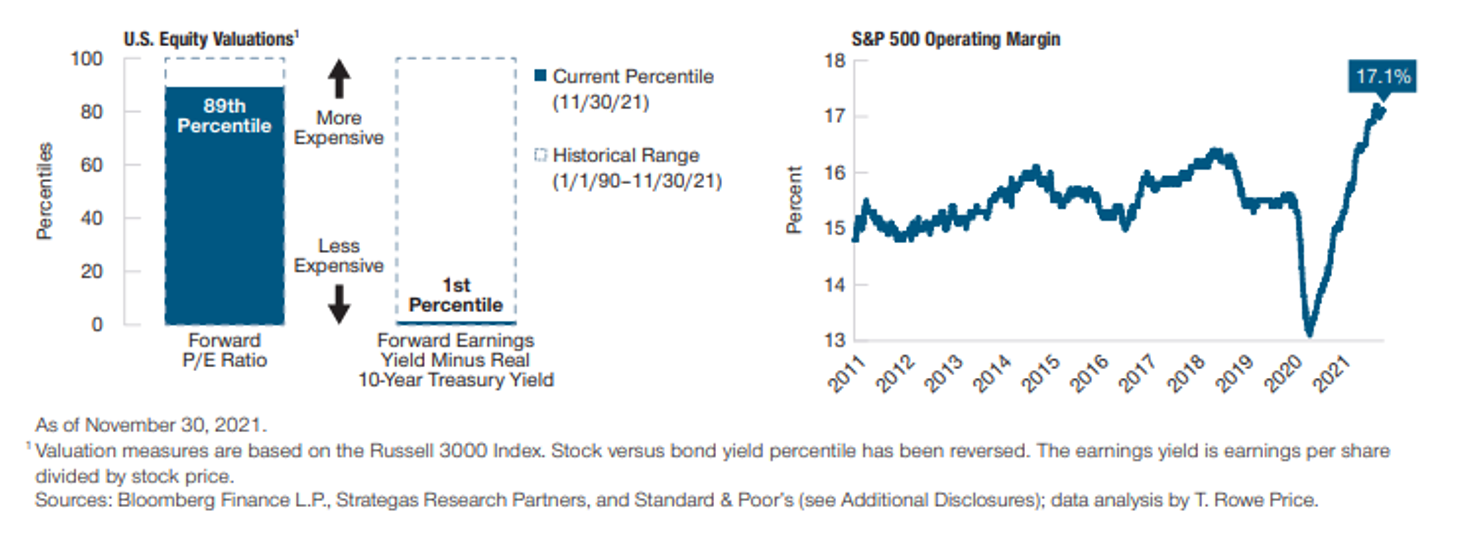

Despite the global market being dominated by COVID, 2021 equity markets performance was strong, and we believe that the overall economic backdrop for 2022 remains positive. Economic growth will likely still improve but at a slowing rate relative to 2021 due to the removal of fiscal stimulus and higher interest rates. Fed Chair Powell has signaled that tapering doesn’t necessarily mean tightening, but the federal funds futures market implies at least 2-3 rate hikes by the end of 2022[5]. Investors should be cognizant that higher rates may affect companies, especially those with negative earnings and cash flows. For example, 30% to 40% of the companies included in the Russell 2000 Index are unprofitable, which should benefit active managers like Oliver Luxxe as we seek to identify profitable, and attractively valued businesses.

Generating strong cash flow in 2022 will be critical as the cost of doing business (i.e., weighted average cost of capital) is increasing due to the anticipated Federal Reserve rate hikes. Our quantitative and fundamental research process helps us find businesses that have quality balance sheets, strong earnings revisions, and attractive multiples.

[5] FactSet

As always please reach out with any questions or concerns.

Thank you,

Joseph Sharma, CFA

Chief Investment Officer

Direct: (908) 741-8340