MARKET COMMENTARY: THIRD QUARTER 2021

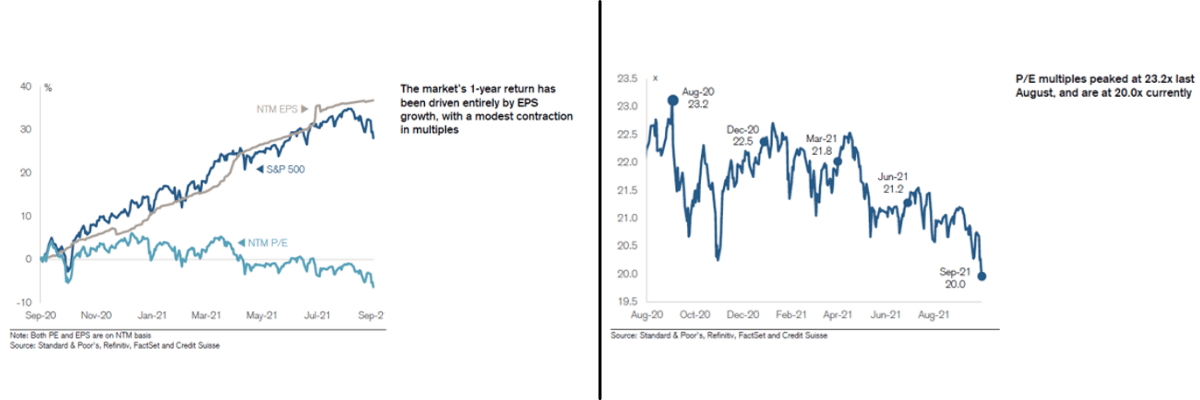

At the sector level, 3Q adj. EPS estimates were led by Energy which increased +23.1%. The energy sector has seen favorable market dynamics, which include producer discipline (keeping oil supply low), elevated WTI crude prices, and increased miles traveled. The primary offset was a weaker Consumer Discretionary (-5.2% EPS estimate revisions) sector which started to lap tough comparisons from COVID, where categories such as recreational vehicles and other home goods ›benefitted from stay-at-home mandates.

We expect companies to trim second-half expectations due to the severe supply and labor constraints and see investors move up the quality curve to select companies with consistent growth versus cyclical companies. This is consistent with our previous recommendation for investors to transition from short-cycle to mid/later-cycle companies. We have already started to see Paint and Coatings companies like PPG, SHW, and AXTA remove 2021 guidance because of limited visibility regarding when inflationary headwinds will abate.

Consensus is expecting 3Q S&P 500 EPS growth of +27.6% Y/Y, which would mark the third-highest rate of improvement since 2010. Over the past five quarters, earnings have surprised to the upside by 19% on average, which has been driven by strong operating leverage and consumer’s ability to withstand price increases[1]. These trends highlight our belief which prioritizes owning companies who can pass through price increases for a like-for-like basis, such as distributors (Wesco, Applied Industrial Technologies) and equipment rental companies like Herc Rentals and United Rentals.

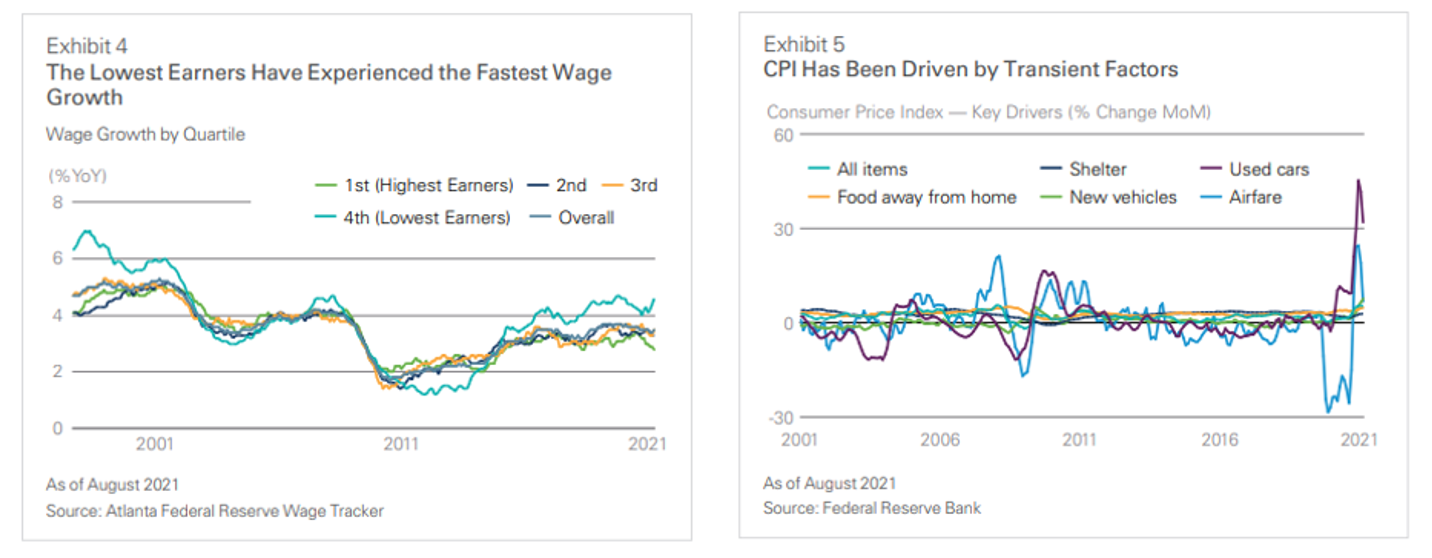

There is a debate whether inflation will be transitory or structural going forward. We continue to believe that certain areas of inflation are unsustainable, such as auto pricing (new & used), stay-at-home goods, and food away from home. On the other hand, rent and labor inflation may be more structural in nature, while energy and transportation costs could see pockets of volatility due to seasonal factors. The recent pronounced volatility in natural gas prices is a good example of these dynamics as we head into Winter.

New Paragraph

OUTLOOK:

Coming out of the depths of COVID, the lowest quality, highest levered names far outperformed high-quality value stocks. With most of the world reopening, we expect economic trends to continue, but financial markets are anticipatory, and most investors believe the easy early-cycle money has been made. We believe focusing on high-quality, mid-cycle investments is prudent at this point in the economic cycle. Regardless of where the economic cycle takes us, we continue to believe that our bottom-up investment process allows us to identify quality companies for our equity strategies.

Heading into the second half of 2021, we believe topical questions for management teams are the following:

- Given the high levels of inflation, how does the company plan to maintain gross margins?

- Coming out of COVID, does the company have structurally higher profitability from previous cost restructuring?

- How does the company prioritize shareholder returns?

We believe that any unwarranted market sell-off may allow us to acquire high-quality businesses that are trading at a discount to their intrinsic value.