MARKET COMMENTARY: SECOND QUARTER 2021

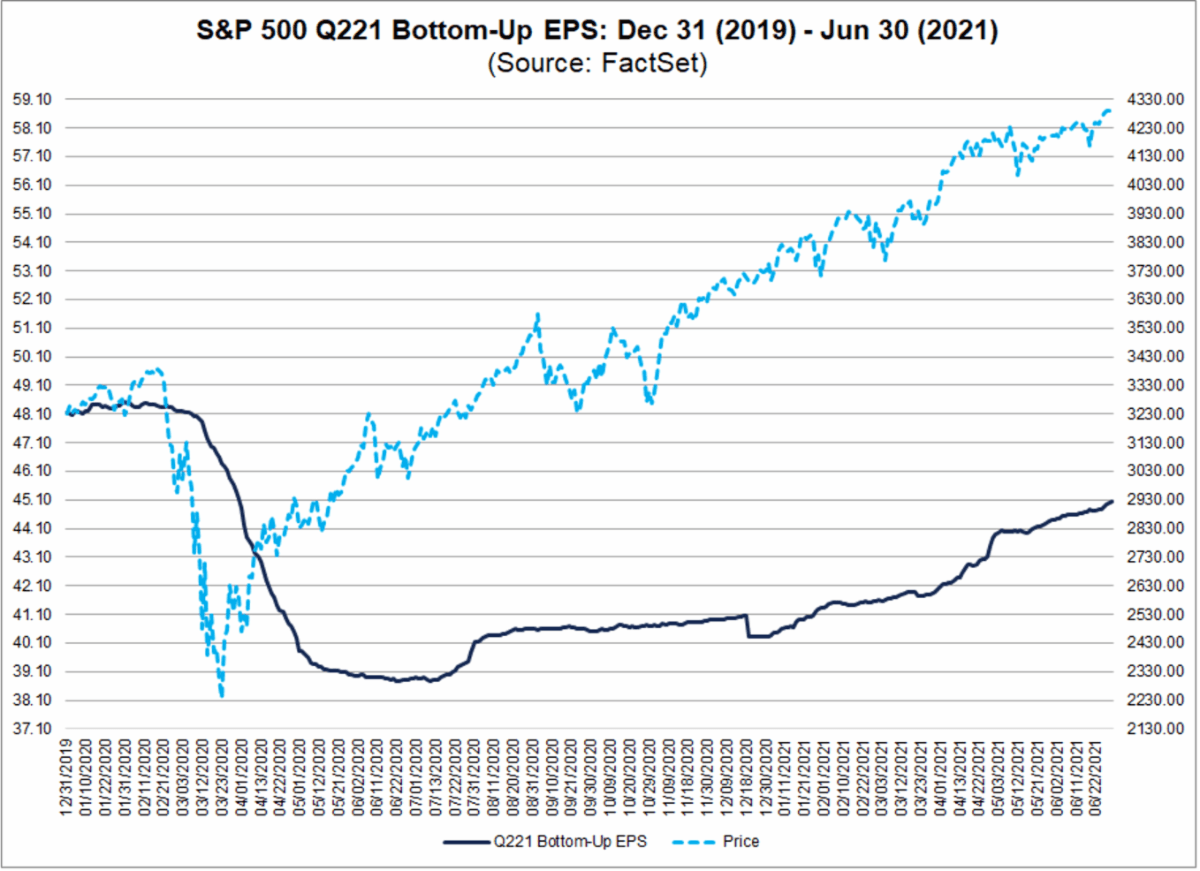

Consensus 2Q21 earnings growth for the S&P 500 is 63.3% Y/Y (highest growth since 4Q09) compared to 52.1% going into the quarter, due to nine sectors seeing positive upward revisions. In terms of 2Q earnings guidance, sixty-six S&P 500 firms have issued above consensus EPS guidance versus 37 companies issuing below consensus guidance. If sixty-six is the final number, this would represent the most firms reporting better than expected earnings since the FactSet database started capturing EPS guidance since 2006.

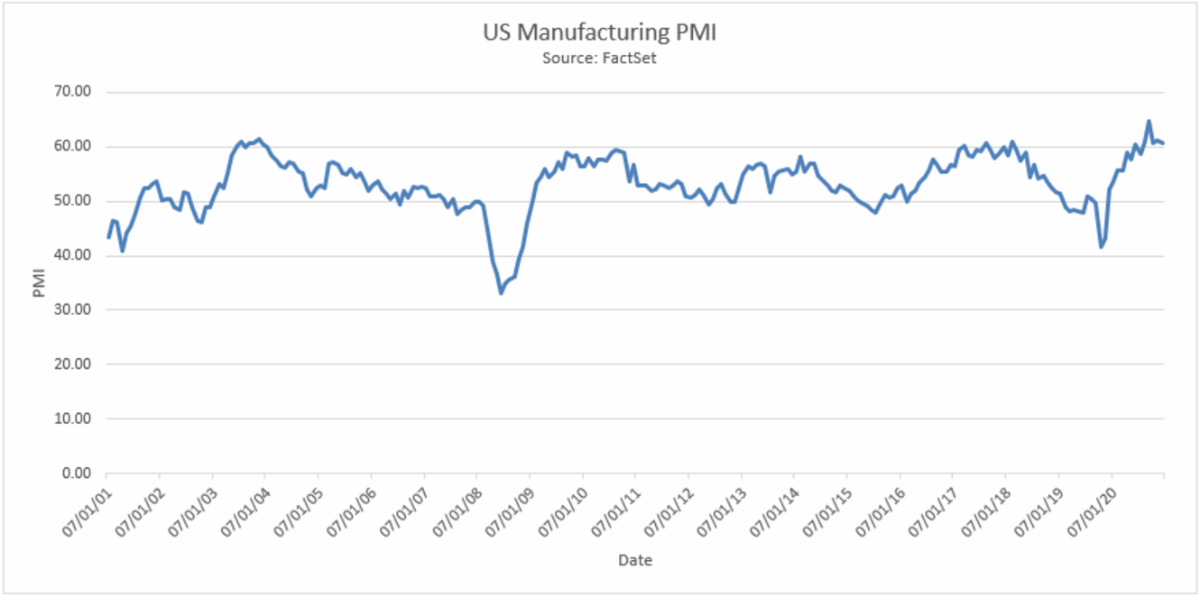

There are a few reasons why we are seeing increasingly more companies announce better than expected guidance. First, analysts may have been too pessimistic in revising earnings higher at the beginning of 2021. Second, overall expectations for global economic growth have exceeded consensus expectations due to record fiscal stimulus, monetary support, and better than expected vaccine roll-outs. Third, broad-based strength in commodity prices has led to the outperformance in metals, oil, and agriculture producers. Many commodities like lumber, steel, aluminum, and iron ore are well above previous highs due to pent-up demand, supply chain inefficiencies, and robust demand.

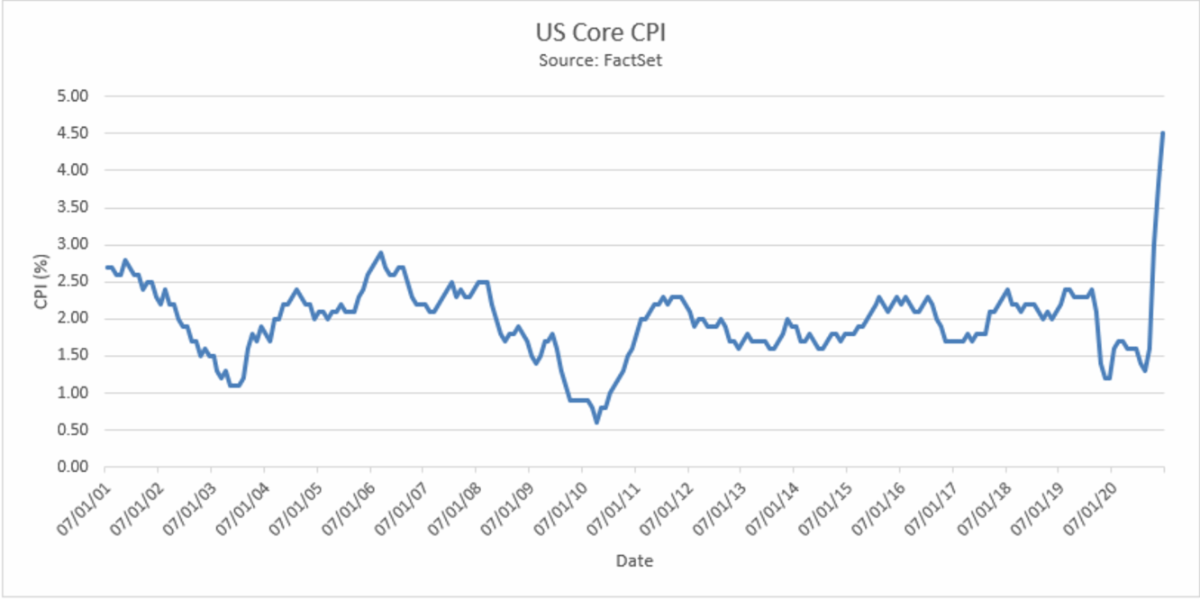

Inflation data has unsurprisingly garnered a lot of attention from equity and fixed income investors. Elevated interest rates drive higher discount rates which negatively affect “longer-duration” (growth stocks) equities, as future cash flows are discounted at higher rates. The core consumer price index (CPI) increased 80 basis points to 3.8% in May, driven by broad-based commodity and wage inflation. This represented the largest increase since 1992 and has caused some Federal Reserve Presidents to hint at potential rate increases in 2023 and beyond. By sticking to our disciplined investment process, we seek to identify high-quality companies that fare well during periods of elevated growth and inflation. Our goal is to purchase companies that possess pricing power from competitive advantages and strong product/service differentiation.

OUTLOOK:

Coming out of the depths of COVID, the lowest quality, highest levered names far outperformed high-quality value stocks. With most of the world reopening, we expect economic trends to continue, but financial markets are anticipatory, and most investors believe the easy early-cycle money has been made. We believe focusing on high-quality, mid-cycle investments is prudent at this point in the economic cycle. Regardless of where the economic cycle takes us, we continue to believe that our bottom-up investment process allows us to identify quality companies for our equity strategies.

Heading into the second half of 2021, we believe topical questions for management teams are the following:

- Given the high levels of inflation, how does the company plan to maintain gross margins?

- Coming out of COVID, does the company have structurally higher profitability from previous cost restructuring?

- How does the company prioritize shareholder returns?

We believe that any unwarranted market sell-off may allow us to acquire high-quality businesses that are trading at a discount to their intrinsic value.